Click to learn more about author Asha Saxena.

A lot has changed since the 1950’s when the average age of a publicly traded company listed on the S&P 500 has gone down from being 60 years old to now less than 20 years old according to research from Credit Suisse investor analysts. Companies that are embracing using new technologies, automation, Big Data, Machine Learning, and innovation are gaining market share on the list, and are disrupting older legacy businesses that have been slower to adapting and transforming to digital changes. In fact 5 of the 6 biggest companies (Apple, Amazon, Alphabet, Microsoft, Facebook) by market cap valuation are data technology businesses. Companies that understand the true value of their data and leverage it with advanced analytics technologies are seeing continued growth. A Forbes contributor Howard Baldwin makes a comparison to prove the point of proving data’s value:

“Why is Facebook currently valued at 415 billion and United Airlines, a company that actually owns things like airplanes and has licenses to lucrative things like airport facilities and transoceanic routes between the U.S. and Asia, among other places, is only worth $24 billion.”

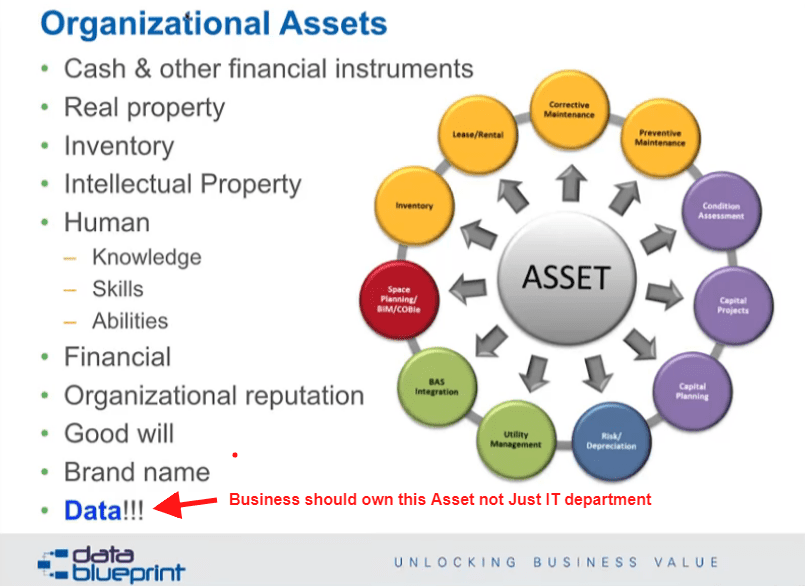

These disruptive innovators, use Big Data solutions as competitive advantages to reduce operational costs, increase revenue, predict behavior, improve cash flows. They weave data into every function of the organization. Data is not only being used to record what has transpired, but it also being used to predict and drive transformative disruptive changes at alarming speeds. And yet how many companies are listing their data as tangible corporate asset on their balance sheet?

What is Your Data Worth?

And yet how does a company measure or place a value on their data? In a MIT Sloan Review article titled “What is your data worth?” which mentioned the 26 billion dollar acquisition of LinkedIn by Microsoft and asked the question. Did they pay a fair price for purchasing LinkedIn’s network user data? Microsoft seemed to think so but then the credit rating agency Moody, on the announcement conducted a review of Microsoft’s credit rating. Point being, there still is no exact formula for placing a value on data or information. According to a data valuation survey conducted by Steve Todd of Dell EMC, that interviewed 36 companies with revenues over 1 billion, found that these companies focused more on the challenges of storing, protecting, accessing, and analyzing massive amounts of data, and not as much on transforming or quantifying its business value.

The research firm Gartner predicts that by 2022, companies will be valued on their information portfolios. Current GAAP accounting standards do not permit data (intangible assets) to be capitalized on the balance sheet. Which currently can lead to considerable differences between the book value and market value of a company, if a tech company wants to IPO, it can lead valuation pricing issues.

Which leaves many analysts wondering especially for information-rich companies should data be counted as a tangible asset.

There are a Few Frameworks for Trying to Put a Value on Data

James E. Short of The Sloan Management Review, defines data value as the combination of a few types of approaches to determining value:

- The asset, or stock, value

- The activity value

- The expected, or future, value

- The prudent value

1. Data as Strategic Asset

For some businesses that looking for a way to capitalize or monetize their data assets they would start to analyze the value of their customer data. Now this is not a new idea, this has been happening in retail stores with using loyalty cards to its customers for decades. But customer data can produce material value (if the data is acquired, sold, traded) or incidently such a when a new product or service is created from leveraging customer data, but the data is not actually sold, Google and Facebook as good examples of this. As an example, The Kroger Co, generates $100 million in incremental revenue per year by selling its inventory and point-of-sale data and “making that available as a syndicated data provider,” according to Search CIO TechTech.

Organizations can take proprietary and publicly available data to create useful data sets for purchase or use as service. Market research firms like The Nielsen Company are an example of this.

2. The Usage Value of Data

The usage of data can often be thought of by the application that captures it – such as a mobile app, CRM or general ledger – and how often it is used or recorded. The frequency of use can be characterized as the application workload, the transaction rate and the frequency of data access. Data use is typically defined by the application — such as a customer relationship management system or general ledger — and frequency of use. The frequency of use is typically defined by the application workload, the transaction rate, and the frequency of data access.

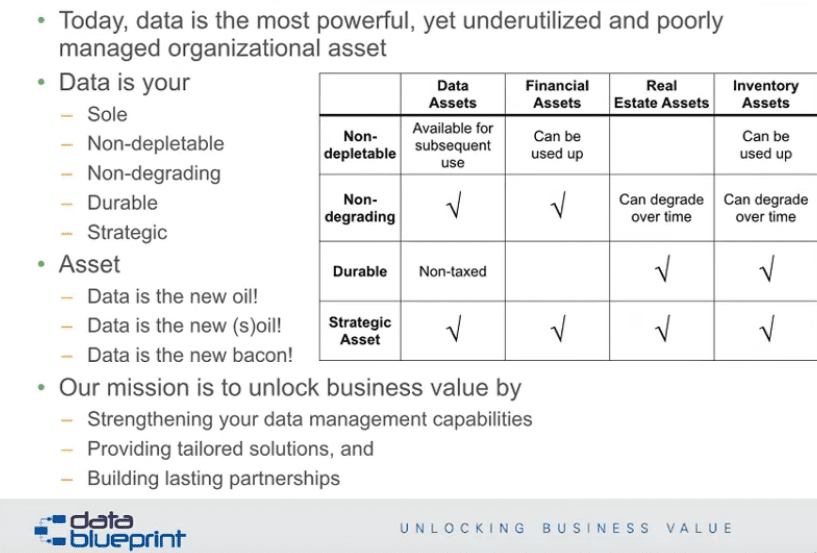

So analyzing the value of data from its frequency of use perspective, can have a unconventional outlook. So in general when you think about tangible assets (machinery, equipment, buildings etc) usually go down in value over down or depreciate the more they get used. Real estate may be the opposite. But data can increase in value the more it get used. In other words, if you view data as asset, then it can become worth more (it is non-depletable, non-degrading, durable, strategic).

Alphabet’s Google Maps GPS navigation and local business listing app integrates crowdsourced review data about places (of which if you have an Android phone Google will send a push notification to encourage a review of a place you just visited) from users in a given location. So the more people engage and write reviews the more valuable the Google maps data becomes to people who use it find some place to go or visit.

Image credit: Datablueprint.com

3. The Expected Future Value of Data

You may hear the terms “digital assets” and “data assets” used somewhat interchangeably, but for accounting purposes there still is no standardized definition of how these assets should be registered on a company’s balance sheet. So currently if data assets get tracked and quantified by a company, it is usually combined in with other types of intangible assets such as patents, trademarks and copyrights etc.

There are a few different methods used for trying to place a value on an intangible asset. One way that is used to put a value on it, is by looking for similar or identical assets in that been in an observable market-based transaction recently. They also can be valued by looking at how much cash flow or income they produce or how much it would cost to replace or develop them.

4. Prudent Value Approach

The “prudent value” approach technique was developed Bill Schmarzo, Dell EMC Global Services CTO, which basically is a way to measure or value data based on the extent it is used or leveraged to make decisions on advancing key business initiatives that align with the company’s overall business strategy. Using this approach can have a couple of benefits:

- It sets a range or ballpark of value for the data set obtained from the financial value of the important business initiative.

- What is more crucial is that it sets the data valuation process around the business decisions that need to be decided to move the business initiative forward. Basically, it measures the methods in which different sets of data could be used and more importantly the projected impact that it has on achieving the project or goal.

- More important, it frames the data valuation process around the business decisions that need to be made to drive the targeted business initiative. It quantifies the ways in which different data sets might be utilized and the impact this could have on the success of the targeted business initiative.

The Concept of “Infonomics”

Doug b. Laney, author of the book Infonomics, and is also a VP and Analyst with the Gartner Chief Data Officer (CDO) Research and Advisory team. In the book Doug discusses that “Infonomics is the theory, study, and discipline of asserting economic significance to data. The book provides the framework for businesses to monetize, manage, and measure information as an actual asset.” He posits that many IT leaders may say that data is one of their company’s most important assets, but do they really manage and treat it like actual asset or even report to the board on the health of their information assets?

As an example, if you were to take a look at your organizations supply chain and asset management divisions for physical assets, or even your financial reporting and management procedures. Doug asks “Do you have similar accounting and asset management practices in place for your “information assets?” and he goes on to say “Most organizations do not.

Image credit: Datablueprint.com

Conclusion

So regardless if information assets are not currently counted on balance sheets, learning to manage, deploy, value and treat data as an enterprise asset can help with:

- Understanding the ROI of Data Management, machine learning and Big Data Analytics investments

- Making better decisions around data monetization initiatives

- Getting a premium valuation for merger & acquisitions deals like LinkedIn did

- Using data to create new products and evolve processes and cut costs